Digital Distribution

Customer-Centric by Design

Target new markets and boost application submissions. INSTANDA's no-code product configuration enables you to create unlimited personalized experiences for brokers, customers, and third-party distributors.

Delight Customers and Expand Your Reach

Rapidly add new distribution channels

Attract new customers and brokers

Maximize quote conversion rates

Enable distributor and customer self-service

Transform the Customer and Broker Experience

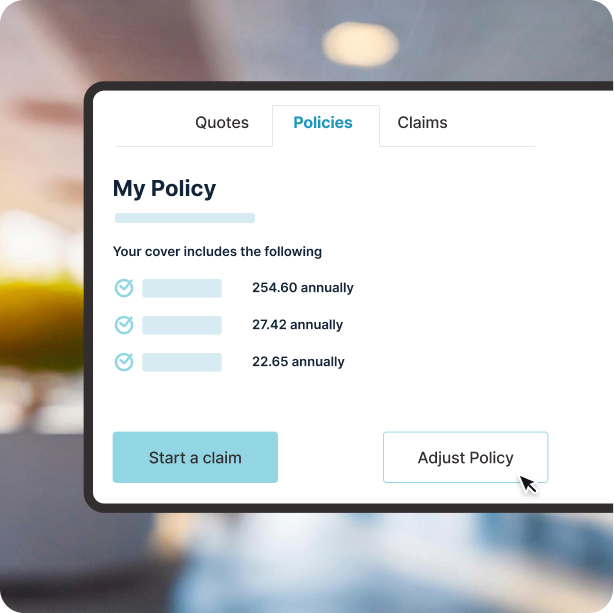

Broker

- Real-time quote and bind

- Document upload, retrieval and e-signature

- Data pre-fill with robust ecosystem

- Rapid broker onboarding and simplified management

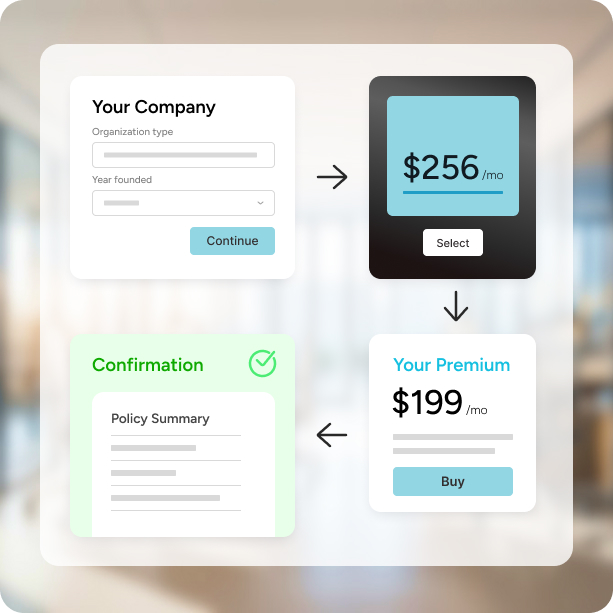

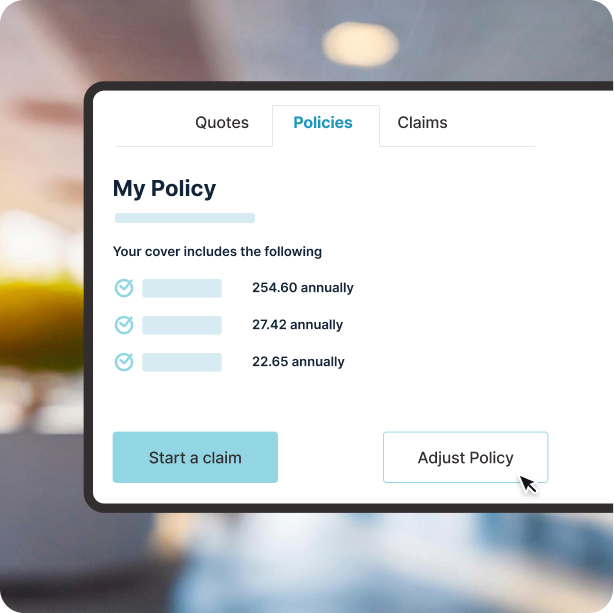

Customer

Policyholders can:

- Seamlessly quote and bind policies

- Make policy changes, pay bills, and view documents

- Submit a First Notice of Loss (FNOL)

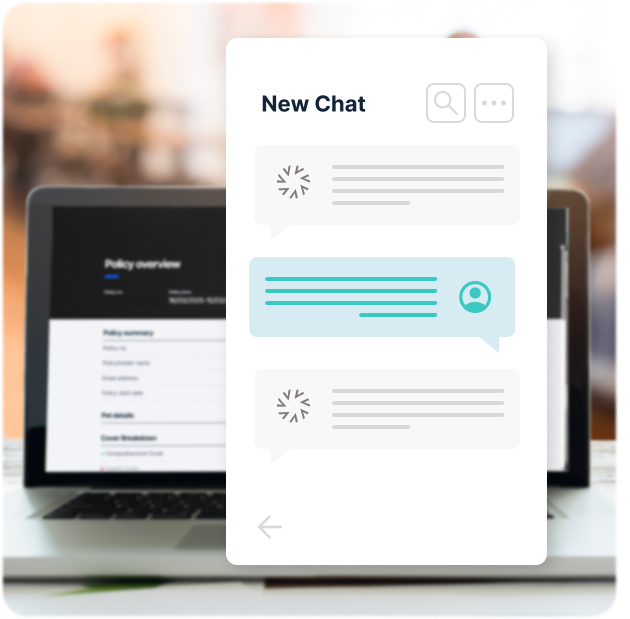

Embedded

- Native support for headless distribution

- Easily embed on websites via API

- Quote and bind via chat and voicebot

- Adopt AI agents to streamline customer experience

Featured Case Study

Meet the Insurers Building the Future

Moonrock Drone Insurance Realizes Lightning-Fast Scalability

Moonrock, an award-winning UK MGA, leverages INSTANDA to quickly create and manage drone insurance products. With INSTANDA’s flexibility, they stay ahead of industry advancements, delivering tailored coverage for every type of drone with ease.

0%

reduction in product delivery times

0%

reduction in external development costs

0 days

reduction to onboard brokers (down from 6 weeks)