In the ever-evolving landscape of multinational insurance, growth is often hindered by the complexities of managing diverse systems across various regions. Rapidly evolving regulations, fragmented systems and diverse customer expectations make innovating at pace a challenge. However, multinational insurers that adopt standardisation as a strategic approach are better equipped to handle these complexities, enabling them to drive efficiency and unlock significant growth potential.

This blog explores why standardisation is a game-changer for multinational insurers, the operational hurdles it can address, and how it can empower insurers to modernise at scale, quickly and efficiently.

The Complexity of Multinational Insurance Operations

Multinational insurers often face a tangled web of local systems designed to address specific regional regulations and market dynamics. While these systems may work well in isolation, they lead to operational silos, inefficiencies and limited collaboration across regions.

Key challenges include:

- Regulatory Diversity: Insurers must comply with varying regulations in every market they operate in, making system alignment a struggle.

- Aging Technology: Existing systems, often built for specific functions in local markets, hinder modernisation efforts and limit scalability.

- Skill Shortages: Fragmented systems demand region-specific expertise, inflating costs and slowing down innovation.

- Customer Expectations: Today’s customers demand seamless, personalised experiences, which can be difficult to deliver across disconnected systems.

Without addressing these challenges, insurers risk lagging behind competitors who are better equipped with modern, standardised approaches.

Why Standardisation Matters

Standardisation involves creating a unified approach for systems, processes and operations across an insurer’s global portfolio. This means consolidating disparate systems into a centralised platform and aligning workflows to ensure consistency while allowing for regional flexibility. The result? Deep agility, efficiency, and seamless collaboration across regions.

Key Benefits of Standardisation:

- Cost Efficiency: Reducing redundancies and consolidating insurance technology ecosystems can lead to significant cost savings and operational efficiencies.

- Agility at Scale: Standardisation enables insurers to replicate successful products, frameworks and processes across regions with minimal effort.

- Strategic Alignment: A standardised platform ensures that regional objectives align with broader corporate goals, improving collaboration and decision-making.

By breaking away from fragmented operations and moving toward standardised systems, insurers can address inefficiencies, enhance productivity and fuel growth.

Breaking Free from the Growth Trap

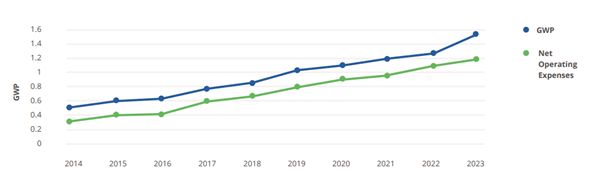

For years, many multinational insurers have found themselves stuck in a 1:1 growth pattern where increases in Gross Written Premiums (GWP) directly correlate with Net Operating Expenses (NOE). This cycle severely limits profitability and scalability.

The Solution

By focusing on standardisation and modernising core operations, insurers can unlock long-term efficiencies. Moving to a single interoperable, scalable system can decouple growth from rising expenses, enabling insurers to achieve sustainable profitability.

Boosting Efficiency with Modern Technology

Standardisation is most impactful when powered by modern technologies. Advanced AI, hyper-automation, and API-first architectures are the driving forces behind modernising the insurance value chain and realigning regional and Group ambitions.

Key Technological Advancements

- Hyper-Automation

AI-powered automation can streamline workflows, reducing the manual burden on teams. Underwriting, claims processing, and customer support can all be handled more efficiently, allowing employees to focus on strategic tasks.

- Configurability for Business Teams

No-code platforms empower business teams to design and deploy new products or update existing processes independently. This reduces reliance on IT resources and accelerates time-to-market for new initiatives.

- Customer Personalisation at Scale

Advanced systems (INSTANDA being a leading example) enable insurers to provide personalised customer journeys by leveraging integrated data and actionable insights. This enhances customer satisfaction and builds loyalty globally.

By adopting these technologies as part of the standardisation process, insurers can achieve transformational improvements across their operations.

Overcoming Implementation Challenges

Transitioning to a standardised system requires proper planning and execution to minimise disruptions and mitigate risks.

Common Challenges and Solutions

- Resistance to Change

Internal resistance is a common hurdle. Insurers must focus on change management, clearly communicating the long-term benefits to stakeholders and teams. Incremental modernisation at pace, rather than a full-scale overhaul, can ease this transition process.

- Data Migration Complexities

Consolidating existing structured and unstructured data into a standardised system involves significant challenges. Robust migration tools and clear governance frameworks can ensure data security and accuracy throughout the process.

- Multi-Year Project Fatigue

To avoid fatigue, insurers should prioritise solutions that deliver short-term wins while keeping long-term transformation goals in mind. As explored in INSTANDA’s whitepaper on multinational insurance system standardisation, SaaS-driven cloud-native platforms enable rapid implementation, minimising downtime and boosting ROI faster.

Best Practice: Consider adopting a “ringfencing” model, where new processes and products are transitioned to modern platforms, while existing systems are maintained temporarily to ensure continuity.

How to Modernise Effectively at Scale

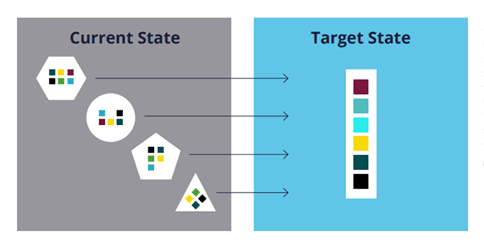

The ultimate goal for insurers is to transition from a fragmented system architecture to a unified, standardised system designed to streamline regional operations and boost efficiency.

Target State Objectives:

1. Single Platform for Operations

Adopt an end-to-end policy administration and distribution platform that supports regional flexibility while ensuring global consistency.

2. Configurable Systems

Look for platforms that enable reusable product and process components, accelerating innovation and simplifying updates.

3. Cloud-Based Scalability

Leverage SaaS solutions with integrated guardrails to enhance agility, lower costs and support operational resilience.

4. API-First Design

Future-proof systems by investing in technology that integrates seamlessly with both current and emerging solutions.

Achieving this state ensures long-term adaptability, empowering insurers to enter new markets, introduce products rapidly, and streamline regional expansion.

The Competitive Edge of Standardisation

Standardisation provides insurers with a clear path to optimised operations, enhanced customer experiences, and sustainable growth. The ability to replicate success, modernise with agility, and reduce operational complexity offers insurers a significant edge in a competitive landscape.

Final Thoughts

Multinational insurers face an inflection point. The path forward begins with reflecting on the unique challenges your organisation faces and reframing them as opportunities for accelerated growth and performance.

Take that first step toward transformation. Download our whitepaper for actionable insights into creating a standardised operational model that aligns your regional and Group ambitions. Standardisation isn’t just about cutting costs; it’s about creating a resilient foundation for future growth.