What is INSTANDA?

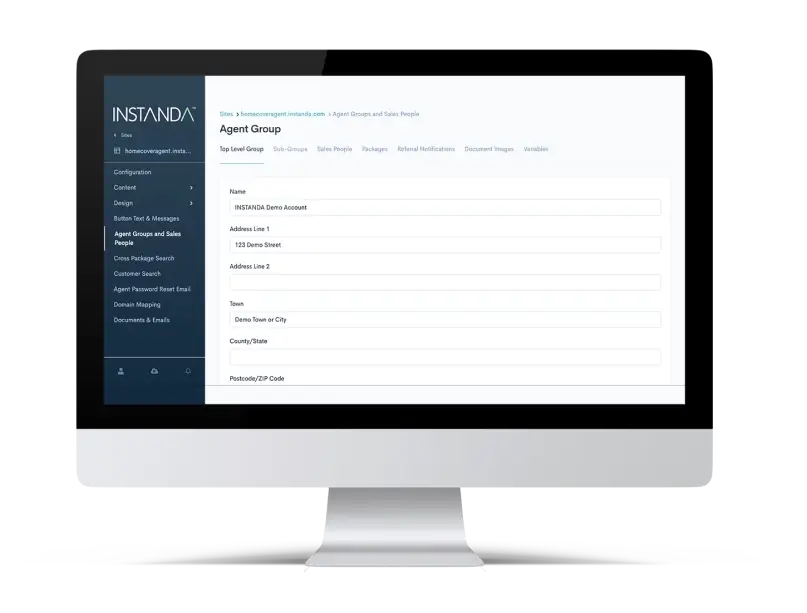

The INSTANDA platform enables carriers and MGAs to create, build and implement complex insurance products in a matter of weeks or months. Capitalise on opportunities and be first to market, all while lowering overall TCO. Seamlessly integrate with your ecosystem and technology environment.

INSTANDA launches Group

Protection & Health Capability

Find out more

A digital insurance solution for the future of insurance

A digital insurance platform designed for insurers by insurers

INSTANDA’s fully customisable policy administration platform allows clients to build for numerous product lines and channels.

Underpinned by sophisticated underwriting and distribution capabilities, INSTANDA gives insurance teams the ability to innovate at scale and deliver solutions to markets at lightning speed.

A platform for property & casualty and life & health

What is your insurance need?

The speed at which businesses need to run in order to remain competitive is changing how insurance organisations operate

This comprehensive global report, curated through one-to-one interviews with 40 insurance experts leading the way in innovation, delves into the intersection between insurance and technology, presenting a once-in-a-generation opportunity to transform the industry and elevate customer outcomes.

The INSTANDA difference

INSTANDA reverses the thought process of a traditional policy admin platform. Starting with the customer experience and allowing the platform to create the back office and data environment.

By rewriting the narrative on how to build and implement products, INSTANDA’s digital insurance management platform is empowering insurers to thrive in a new generation of insurance. By putting control in the hands of insurers, creating customized products with speed and ease can now become the norm.

Traditional PAS

Data Model

Backoffice capabilities

Customer Experience

INSTANDA Customer Experience

Customer Experience

Backoffice is configured

Data model is

built dynamically

Break into new markets and strengthen existing portfolios while the competition drags its heels

Seamlessly integrate with 100s of world-class platforms

Our integrations help insurers modernise IT, build seamless customer experiences and promote innovation.

Popular integrations

“INSTANDA brings the comfort of a known and proven approach, along with an flexibility to rapidly configure and launch new products, built by business owners to quickly and effectively address market needs. Our joint success has been built on deploying new propositions and launching entire new businesses in the matter of weeks with the simplicity, speed and agility of INSTANDA at the core.”

Andy Lees, Partner, Deloitte.